Setting up in Business, and confused about whether you should opt for Sole Trader, Limited Company status, or a Partnership? Read below.

Sole Trader

This is generally the simplest option, and the route many take, especially when starting up. Effectively, you are the business – from a tax and legal perspective! You are personally responsible for running the business, and you decide if and when you want to stop operating. You are also personally responsible for any debt the business may incur.

Some of the benefits include:

- Setting up is very simple – you can simply register online with HMRC, and let them know what the business is.

- You are able to easily take money out of the business as and when you want, because your personal finances and the business’s finances are essentially one and the same. It is best to have a separate bank account for the business though, to make accounting easier.

- Details of the company don’t need to be made public. This provides a greater level of anonymity for owners, and there are less costs relating to filing your annual accounts, as they don’t need to be audited by an accountant and submitted to Companies House.

- The business is easier to close down.

From an obligations point of view:

- You will still need to make sure you are VAT compliant (if over the VAT threshold), pay any PAYE and NI payments to HMRC for any staff you may have.

- You will need to complete an annual self-assessment tax return each year based on your income and expenses. Any tax will need to be paid on your net profit (ie profit – costs), and in line with the Government Income tax bands.

- You will need to pay Class 2 or Class 4 National Insurance contributions, depending on earnings.

Limited Company

Limited companies, are a separate legal entity to you. You are not the business in the same way you would be as a sole trader. You are a director, shareholder and employee of the business, with any assets and debts belonging to the company, not you personally.

Some of the benefits include:

- You aren’t held personally responsible for any debts if the company becomes insolvent.

- Potential tax savings, as you can take income in the form of a salary and dividends (rather than as a profit)

- The company is owned by shareholders. You can keep all the shares yourself, or allocate them to someone else (eg a spouse, business partner).

- Limited companies convey a more professional image

- Flexibility, as you can sell shares easily to raise investment and funding

From an obligations point of view:

- The company must be formed, or incorporated, and registered at Companies House.

- You must also be registered with HMRC, the same way as a sole trader would be.

- You must complete and file audited accounts with Companies House on an annual basis. They need to be produced by a qualified accountant.

- As a limited company your business is liable for tax on business profits, with the tax rate at 19% on profits up to £300,000 (18% from April 2020).

- Closing down a limited company takes time - you can’t just stop trading. The business needs to be formally wound up or struck off by Companies House.

Partnership

A partnership arrangement is similar to that of a sole trader but has more than one owner. Partners are all responsible for profits and liabilities, and pay tax on the percentage. Ownership doesn’t need to be equally split.

Some of the benefits include:

- You share the responsibility. Having more than one business owner means that the financial and operational responsibility for running the business is split.

- Partners share the decision making. This can help take the pressure off big decisions, as there are others to discuss the options with.

- Partnerships are easy to form, and they can be very versatile. It is easy to make changes to a partnership.

From an obligations point of view:

- All partners own a specified percentage of the profits, and the liabilities, so they must pay tax on that percentage.

- As with a sole trader, each partner’s share of the profits is treated as their income.

- Each partner needs to submit a tax return, similar to that needed by a sole trader and a director of a limited company.

- You need to register the Partnership with HMRC, and complete relevant paperwork each year.

There is another option called a Limited liability partnership (LLP). This is kind of a blend of a Partnership and a Limited Company. They can be a little more complex, and if you are considering this type of arrangement, it is advised you seek advice on whether it is right for you. It tends to be used by professional services firms such as solicitors, architects etc.

So, Sole Trader, Partnership or Limited Company?

Overall, operating as a sole trader entails a simpler process. You can get going with the minimum of admin. Thereafter, completing an annual tax return is easy, and you can do this on your own. Just bear in mind that you will take on the risk of being individually responsible for any debts your business incurs.

Limited companies remove the personal responsibility for business debts. You can also minimise your personal tax by paying yourself less salary and greater dividends. However, setting up is a little more complex, and once you’re up and running you’ll need to employ an accountant to produce your annual accounts for Companies House.

The partnership option can work well if there are more than one of you in the business, but you don’t want to be a limited company.

The choice is then which suits you best. If you are unsure what will work best for you, speak to someone who can guide the process, and help you start trading the right way from day one!

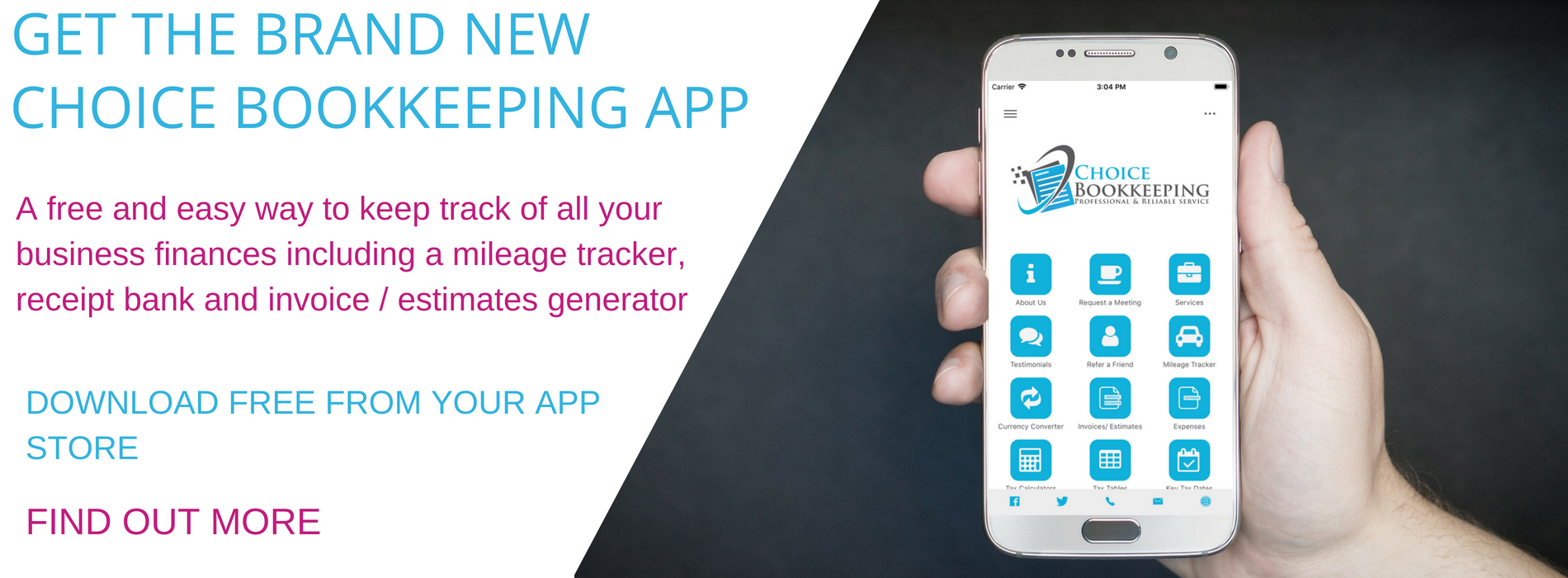

Contact the team at Choice Bookkeeping are on hand to help with all your bookkeeping needs, and advice on which way to set up in business. As an affordable alternative to an expensive accountant, speak to Choice Bookkeeping for a free consultation to see how they can assist you and your business. With offices in Usk and Pembrokeshire, they cover all of South and West Wales and the surrounding areas, the team are ready to help you.